Gilles Smith Purdum Insurance Agency LLC

8:30am - 5:00pm 8:30am - 5:00pm 8:30am - 5:00pm 8:30am - 5:00pm 8:30am - 5:00pmClosed Today Closed Today

8:30am - 5:00pm 8:30am - 5:00pm 8:30am - 5:00pm 8:30am - 5:00pm 8:30am - 5:00pmClosed Today Closed Today

| Day of the Week | Hours |

|---|---|

| Monday | 8:30am - 5:00pm |

| Tuesday | 8:30am - 5:00pm |

| Wednesday | 8:30am - 5:00pm |

| Thursday | 8:30am - 5:00pm |

| Friday | 8:30am - 5:00pm |

| Saturday | Closed |

| Sunday | Closed |

Why Choose a Travelers Independent Insurance Agent?

You can expect thoughtful attention from an experienced agent who will evaluate your unique circumstances, answer your questions, support you throughout your journey and recommend the right mix of coverages to help protect all the things that are important to you and your family. You get a trusted insurance advisor and champion for your needs when you choose a Travelers independent agent.

SPEAKER: Choice. It's something we take for granted. The ability to determine what's best for us-- our needs, our life, our choice. In fact, choice is something we as Americans can't even imagine doing without. And yet when it comes to something as important as protecting ourselves, our property, our family, some people surrender choice without even knowing it. Because they don't choose an independent insurance agent. You see, some insurance agents work for only one company, so they can't offer you a choice of brands and policies. But independent agents aren't held captive by one company. They're free to tailor solutions to fit you, your needs, your life, to help you make the choices that are right for you. If you ever need to file a claim, your independent agent can help you through the process. And as life changes, you can even count on your independent agent to help you update your choices. Those are just a few of the reasons choosing an independent insurance agent is such a good choice. See the difference for yourself.

Featured Products

![Injured man covered by Workers Compensation at gym]()

Workers Compensation

Workers CompensationWith more than 100 years of experience, we have built a broad range of innovative services, all delivered locally in your community.![Woman on laptop looking for small business owner insurance]()

Small Business Owner's Policy

Small Business Owner's PolicyProtects your business from property and (general) liability risks with a bundled, affordable solution that meets the general needs of your small business.

Travelers has been an insurance leader, committed to keeping pace with the ever changing needs of our customers, for over 160 years. As one of the nation’s largest property and casualty companies, we offer a variety of competitive policy options and packages to help ensure you get the right coverage at the right price. An independent Insurance Agent can help you create a policy that addresses your needs and budget.

We also give you peace of mind with a claim process that is simple and stress free. It is about making the process after any incident as simple and stress-free as possible. We’re here to support our customers and their families on the road to repair and recovery every step of the way — with fast, efficient claim services and insurance specialists available 24 hours a day, 365 days a year.

·The value of the company assets you wish to insure.

·Number of employees.

·Specific risks associated with your industry.

·Your personal risk tolerance and the amount of liability protection you prefer.

Featured Articles

![Man with hands on steering wheel.]()

Telematics: 5 Reasons to Try "Pay How You Drive" Car Insurance

Telematics: 5 Reasons to Try "Pay How You Drive" Car InsuranceWith the ongoing development of technology in cars to help us drive safely, there is an opportunity to help raise awareness of your driving behaviors.![Man setting up smart technology at home.]()

How Smart Home Technology Helps Protect Your Home [Video]

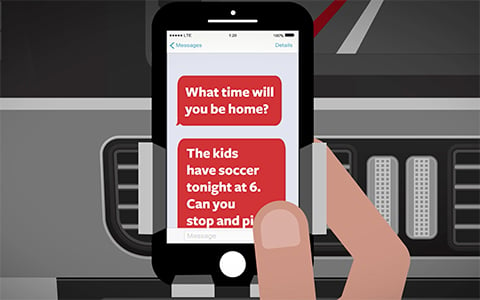

How Smart Home Technology Helps Protect Your Home [Video]Smart home technology offers ease and convenience. It can also help protect your home and reduce home insurance costs.![Animated image of a hand holding a phone, meant to interpret someone reading text messages and being distracted from the road]()

Stop Distracted Driving: Texting [Video]

Stop Distracted Driving: Texting [Video]Every second you take your eyes off the road to do another task, like text, read, reach over, groom or eat, can be dangerous. Share these videos to help raise awareness.![A graphic of the outline of the globe with a closed lock and checkmark]()

Cyber Risk Pressure Test [Tool]

Cyber Risk Pressure Test [Tool]What could your company be doing to better manage cyber risk? Take our four-part questionnaire to find out.![A night image with text across a building stating "Extreme Weather and your business".]()

Extreme Weather and Your Business [Video]

Extreme Weather and Your Business [Video]Disaster events can affect any business, and getting back up and running may take longer than you think.![A graphic image titled "What is a BOP?"]()

What is a Business Owner's Policy (BOP)? [Video]

What is a Business Owner's Policy (BOP)? [Video]A Business Owner's Insurance Policy (BOP) can help safeguard your company from property damage, loss, and lawsuits in the wake of unforeseen events. Watch this video to learn more.

Personal Insurance

Email Us

Email Kim Gilles